Dear neighbor,

The Indiana General Assembly has reached the halfway point in the 2024 legislative session. I wanted to share with you some highlights of my work during this time. As always, reach out to my office at h87@iga.in.gov or call 317-233-5248 with any questions, concerns, or thoughts about legislation.

Sincerely,

Child Care Policy

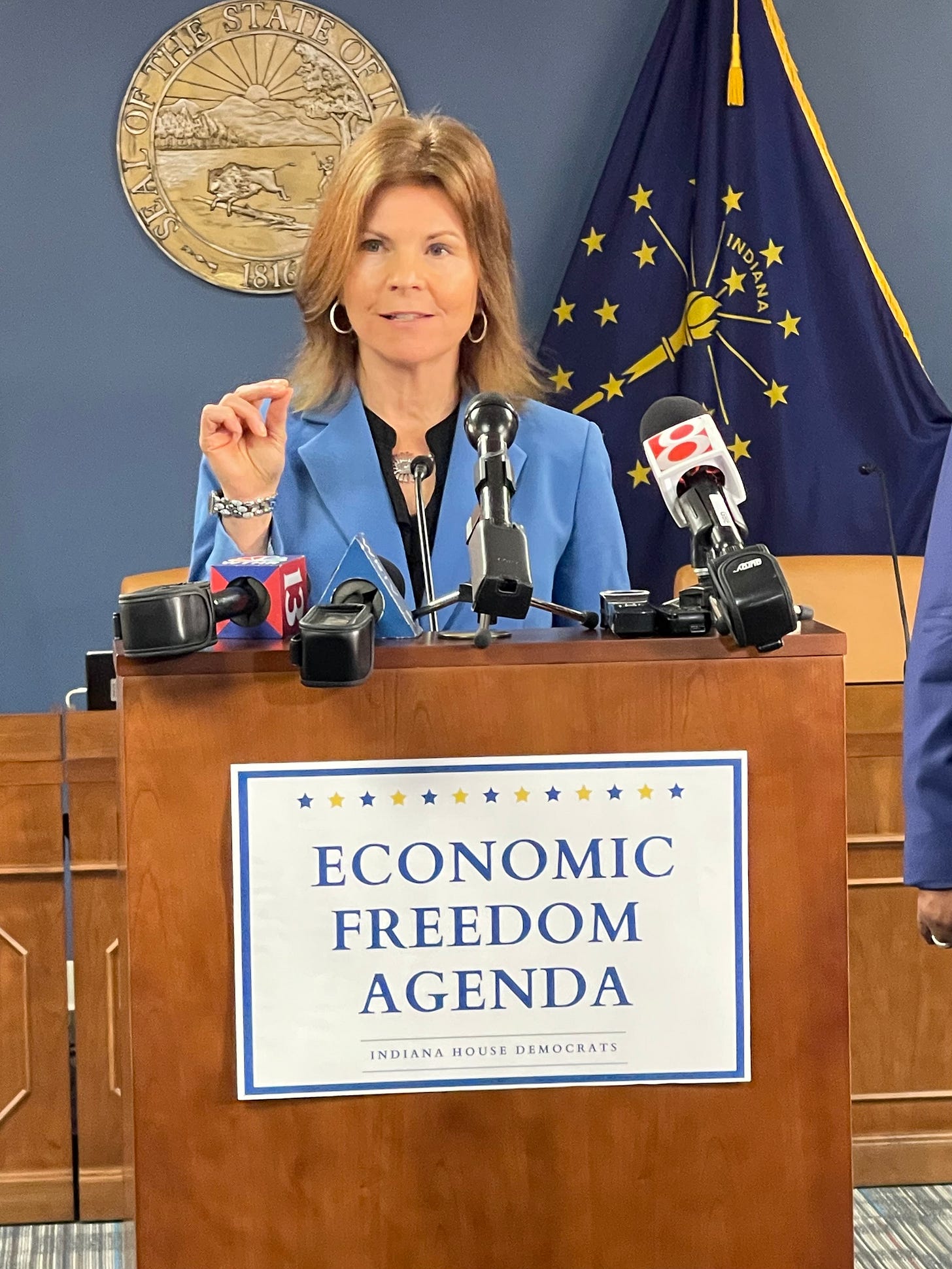

During the first week of session, the Indiana House Democratic Caucus announced our agenda, which includes supporting access to affordable, high-quality childcare. Childcare is critical infrastructure in any modern economy and Indiana's childcare system is in crisis. In fact, annually, Indiana loses $1.1 billion in economic activity and $118 million in lost tax revenue as a result of this crisis.

A 2023 survey found that 59% of parents cut back on hours or left a job because they couldn’t find reliable, affordable child care.

Solving this crisis is good for families and good for our economy.

We propose three tested policy solutions, all of which I’ve been working to advance in recent years::

1) Providing a childcare tax credit,

2) Expanding access to affordable "out of school" programs for school aged kiddos, and

3) FINALLY providing PreK for all!

This video includes segments of my remarks during the press conference.

Fighting Back Against Predatory Lending

In mid-January, I spoke at a press conference hosted by the Hoosiers for Responsible Lending Coalition about my legislation that would crack down on predatory lending in Indiana. I authored House Bill 1171 to cap payday loans at an annual rate of 36%, which is the recommended national standard to break the cycle of debt for households that turn to payday loans to make ends meet. Currently, 18 other states have passed legislation to cap payday loans at 36%.

Under current state policy, the interest rate on a $500 14-day payday loan can be as high as 391%. Charging struggling Hoosiers an interest rate of nearly 400% is simply wrong.

Aside from the moral question of predatory lending, the economic drain on our state is substantial. In 2021 alone, according to a recent study from the Indiana Community Action Poverty Institute, Hoosier payday borrowers could have saved more than $26 million if interest was capped at 36%. This $26 million is not only a direct loss of spending power but has a compounding economic cost in human capital. For families who end up in a debt trap, they may lose transportation to work if their vehicle is repossessed, or the academic performance of their children may decrease due to the stress of financial hardship at home.

It is time to end the stranglehold that predatory lenders have on Indiana. I am disappointed that the Republican supermajority would not give this issue a hearing, but I pledge to continue to build support for responsible lending laws for as long as I serve in the legislature.

Climate Advocacy Day

One of my favorite days of the session every year is getting to be a part of this youth-led movement to advocate for climate policy at the Statehouse. This year, I was honored to host this event alongside some of the best and brightest young leaders in the state.

In my continued effort to help Indiana build more climate resilient communities and leverage our manufacturing strength to attract the quickly growing low-carbon economy jobs of the future, I authored two bills this session on this topic. House Bill 1193 to allow for ratepayer-saving community solar initiatives, and House Bill 1172 to create an interim study committee on climate resilience and economic growth. Neither of these bills were granted a hearing by the Republican supermajority. I will continue to work with a wide range of stakeholders - from business and agriculture to academic and of course our youth leaders to advance these pragmatic and forward looking policies.

Making Voting Easier

I offered an amendment to House Bill 1264 that would extend the hours of operation for polling places from 6 p.m. to 8 p.m. The amendment was struck down with a vote of 30-67 along party lines.

According to the 2023 Indiana Civic Health Index, Indiana ranked 50th in the nation – dead last – for voter turnout in 2022, a mid-term election year. During presidential election years, we've dropped from 36th worst state for voter turnout in 2012 to 46th worst in 2020.

It is no coincidence that we have such low turnout when Indiana is one of only 2 states in the nation that close polling locations at the early hour of 6 pm. A 6 pm closing time stands as a major barrier for working Hoosiers to participate in elections– including working parents, people working multiple jobs, health care workers, public safety officers and any blue-collar shift workers. By extending polling hours by just 2 hours to 8 p.m., we are ensuring that our hard-working Hoosiers are not excluded from the electoral process.

Democracy is not a spectator sport. The United States was founded upon the principle of government being a reflection of the will of the people. How can legislators confidently say that we are representing the voice of our communities when we let obstacles like this stand in the way of working Hoosiers getting to the polls? We should be making every effort to increase our voter turnout to strengthen our democracy, not upholding antiquated policies that restrict participation.

Fighting for Indianapolis and for Local Control

This week House Republicans voted to pass House Bill 1199 which repeals the Mile Square economic enhancement district (EED) law. This law was adopted by the Indianapolis City-County Council after EED-enabling language was included in the 2023 Republican-passed state budget. The funding tool would provide the city with an additional $5.5 million a year for public safety, homeless shelter funding and beautification enhancements. Additionally, House Republicans also passed House Bill 1121 which will increase income taxes on all Marion County residents as a so-called compromise to pay for Mile Square improvements.

Less than a year ago, the Republican-passed state budget allowed for the creation of economic enhancement districts (EEDs). The hyper-local EED funding model is overwhelmingly supported not only by the Indianapolis City-County Council, but by downtown businesses and other property owners. Through an annual fee, property owners fund targeted investments within the Mile Square. The funding would support desperately needed upgrades to downtown including street cleaning, support and shelter for the homeless and new public safety technology. This is a hyper-local needs funding strategy that combines private and public funding to ensure our downtown is vibrant, safe and welcoming.

Instead of securing funds from willing participants, House Republicans propose shifting the cost to the entire county. They propose raising the income tax on all Marion County income taxpayers to pay for mile square investments. I will not support a tax increase for my constituents when we have a better solution available. This take-back of local authority nullifies plans already put in motion, plans that garnered broad support from Mile Square businesses, property owners, and the Indianapolis City-County Council.

Protecting Families with Disabled Children

Thanks to a massive Republican budgeting error, FSSA (the State agency in charge of Medicaid services) has notified families with disabled children that essential services will be cut. I strongly oppose this decision and will fight to restore this program for our most vulnerable families and children. See more about this issue here:

Dear Rep. Hamilton,

Can you please clarify something for me? While I have seen many news reports about the state rescinding funding for parents to care for their special needs children because of budget shortfalls in Medicaid funding, I have also seen numerous commercials indicating that the state seems to have found the money to fund the Pathways programs to provide services to seniors receiving Medicaid such has home care and transportation. I do not have a special needs child, nor do I qualify for Medicaid, but this seems to be "robbing Peter to pay Paul." Perhaps you have a perspective of which I am unaware. Thanks. Kathleen S. Yates